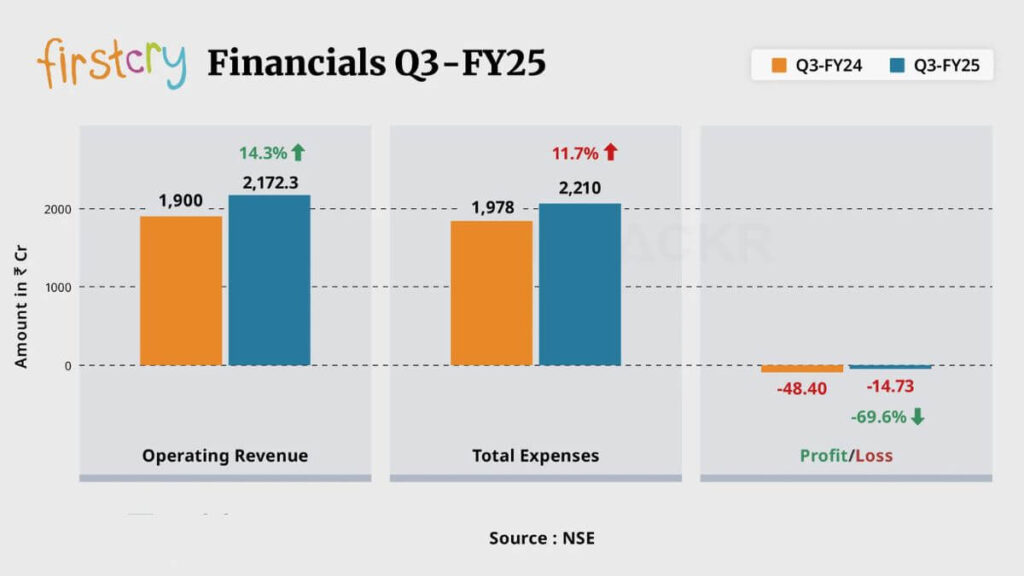

Brainbees Solutions, the parent company of FirstCry, has announced its Q3 FY25 financial results. The company has shown strong growth and improved profitability in the third quarter. FirstCry reported a revenue of ₹2,172 crore, a 14.3% increase compared to ₹1,900 crore in Q3 FY24. It also successfully cut its losses by 70%, showcasing improved operational efficiency.

FirstCry is a leading omnichannel retailer focusing on kids and baby products. It sells products both online and through physical stores across India and in the international market. The sale of its products through these channels contributed around 82% of the company’s total operating revenue. Its subsidiary, GlobalBees, added ₹422 crore to its revenue. Additionally, FirstCry earned ₹44 crore as interest income, bringing its total revenue for the quarter to ₹2,217 crore.

Revenue Growth Driven by Strong Sales Performance

FirstCry’s significant revenue growth came primarily from the sale of its products in India and abroad. The company’s extensive network of offline stores and strong online presence helped it capture a larger market share. The omnichannel strategy has allowed FirstCry to reach a wider audience and boost its overall sales.

GlobalBees, a subsidiary of Brainbees, also played a vital role in the company’s revenue growth. GlobalBees focuses on building and scaling digital-first consumer brands. Its contribution of ₹422 crore in Q3 FY25 was a substantial part of FirstCry’s total revenue.

The company’s overall business strategy focuses on expanding its reach while keeping costs in check. This approach has helped FirstCry maintain steady growth and improve its financial position.

Managing Costs for Better Profitability

Despite the growth in revenue, FirstCry managed to control its expenses effectively. Procurement of materials remained the largest cost, accounting for 66% of its total expenditure. The procurement costs increased by 17% year-on-year, reaching ₹1,451 crore in Q3 FY25, compared to ₹1,239 crore in Q3 FY24.

Employee benefits were another significant expense, amounting to ₹177 crore. This figure includes ₹28 crore allocated for employee stock options (ESOPs). The company’s other major expenses included marketing, legal services, rent, and technology costs. Despite these expenses, FirstCry kept its overall expenditure growth at a manageable level. Its total expenditure rose from ₹1,978 crore in Q3 FY24 to ₹2,210 crore in Q3 FY25.

Positive EBITDA and Reduced Losses

FirstCry’s ability to manage its costs efficiently helped it achieve a positive EBITDA of ₹152 crore for the quarter. This reflects the company’s focus on improving its core operations and reducing unnecessary expenses.

Most notably, FirstCry reduced its net losses by a remarkable 70%. The company reported a loss of ₹15 crore in Q3 FY25, compared to much higher losses in previous quarters. This significant reduction highlights the company’s progress toward achieving profitability.

FirstCry’s Market Performance and Share Price

FirstCry’s stock performance also reflected the company’s financial growth and improved outlook. As of the last trading session, FirstCry’s share price stood at ₹419 per share. The company’s total market capitalization reached ₹21,753.8 crore, approximately $2.5 billion.

The positive financial results have strengthened investor confidence in the company. FirstCry’s consistent growth and reduced losses make it a promising player in the retail market.

Future Growth Prospects

FirstCry’s focus on expanding its omnichannel presence will continue to drive its growth. The company plans to increase the number of its offline stores and enhance its online shopping experience. By offering a seamless shopping experience across multiple channels, FirstCry aims to attract more customers and boost sales.

Its subsidiary, GlobalBees, will also play an essential role in FirstCry’s future growth. GlobalBees is helping FirstCry expand its portfolio of consumer brands and reach new markets. This strategy will likely contribute significantly to the company’s revenue in the coming quarters.

In addition, FirstCry is investing in technology to improve its operations and provide a better customer experience. Enhanced data analytics and personalized marketing will help the company better understand its customers and offer products that meet their needs.

Also read | AbleCredit Secures $1.25M Seed Funding Led by Merak Ventures

Conclusion

FirstCry’s Q3 FY25 financial performance reflects its strong market position and operational efficiency. The company’s revenue growth and a significant reduction in losses are signs of a well-executed business strategy. With a positive EBITDA and growing market capitalization, FirstCry is on a path to long-term success.