In today’s digital world, trust and security are paramount. Whether you’re opening a bank account, signing up for an online marketplace, or even creating a fantasy sports team, verifying identities is crucial. This is where IDfy comes in.

What is IDfy?

IDfy is a cutting-edge identity verification platform that empowers businesses to onboard users securely and efficiently. Let’s delve into the details:

Introduction to IDfy

Founded in 2011, IDfy is a leading provider of identity verification solutions. They offer a comprehensive suite of tools to help businesses:

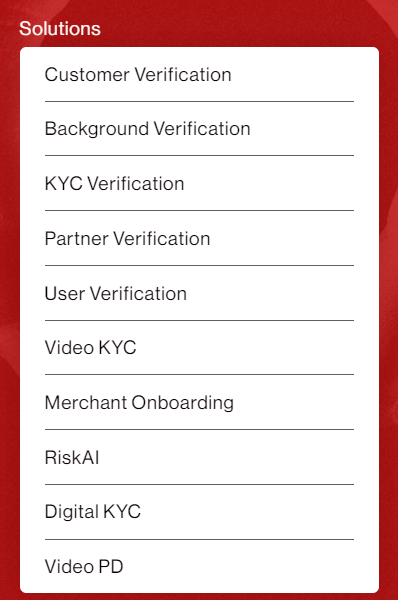

IDfy offers a comprehensive suite of services, including:

- Identity Verification: Seamlessly verify user identities using advanced technology.

- Background Verification (BGV): Conduct thorough background checks to mitigate risks.

- Data Extraction and Document Collection: Efficiently extract relevant data from documents.

- Merchant Onboarding: Simplify the onboarding process for merchants.

- Fraud Detection: Detect and prevent fraudulent activities.

- Video Know-Your-Customer (KYC): Leverage video-based KYC services.

IDfy serves more than 1,500 clients from various industries such as BFSI, FMCG, e-commerce, gaming, the sharing economy, and conglomerates. The company’s clients and partners are across India, Southeast Asia, and the Middle East. Some of its prominent clients and partners include Amazon, Airbnb, HDFC Bank, Dream11, and VISA.

Recently IDfy secured $27 million in primary and secondary funding

Mission

IDfy’s mission is to deliver these verification solutions with minimal disruption to the user experience. They believe in creating a secure and trustworthy environment without creating unnecessary hurdles.

Core Features and Capabilities

IDfy’s platform boasts a variety of features to ensure seamless and secure identity verification:

- Document Verification: Validate the authenticity of government-issued IDs like passports and driver’s licenses.

- Database Verification: Cross-check information against official government databases.

- Facial Authentication: Use facial recognition technology to verify a user’s identity through a selfie.

- Automated Workflows: Streamline the onboarding process by automating identity checks.

- Background Verification: Conduct background checks (depending on regulations) for pre-employment screening or other purposes.

- Global Reach: Cater to a global audience with solutions that comply with international regulations.

Why Use IDfy for Identity Verification?

IDfy offers a wide array of services, making it an ideal choice for businesses. Let’s explore why you should consider using IDfy:

Advantages of Using IDfy

- Enhanced Security: IDfy prioritizes user data security with bank-grade encryption and robust anti-fraud measures. This ensures user information is protected throughout the verification process.

- Frictionless Onboarding: IDfy streamlines identity checks through automation, minimizing disruption for your users. This translates to a smoother onboarding experience and potentially higher conversion rates.

- Global Reach: IDfy caters to a worldwide audience with verification solutions compliant with international regulations. This makes it ideal for businesses operating across borders.

- AI-Powered Accuracy: IDfy leverages artificial intelligence and machine learning for faster and more accurate identity checks. This reduces errors and manual intervention.

- Scalability and Customization: The IDfy platform scales to meet your growing business needs. Additionally, it offers customizable solutions to fit your specific industry requirements.

Industry Applications and Use Cases

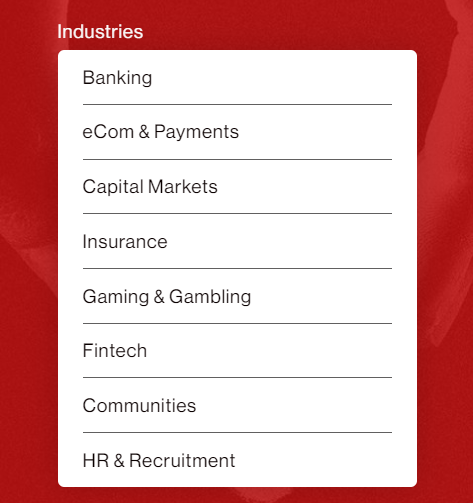

IDfy’s versatility makes it a valuable tool for various industries:

- Financial Services: Banks and fintech companies can verify customer identities for account opening, loan applications, and secure transactions.

- E-commerce: Online marketplaces can ensure user authenticity and combat fraudulent activities.

- Gaming Platforms: Verify user age and identity to comply with regulations and prevent underage gambling.

- Professional Services: Conduct background checks for pre-employment screening or verify client identities for professional licensing purposes.

- Healthcare: Streamline patient onboarding and ensure the validity of medical insurance information.

How IDfy Stands Out

Here’s what makes IDfy a frontrunner in the identity verification game:

- Focus on User Experience: IDfy prioritizes a smooth and user-friendly verification process without compromising security.

- Advanced Fraud Detection: Their AI-powered system effectively detects fraudulent documents and suspicious user activities.

- Regulatory Expertise: IDfy stays current on evolving regulations to ensure your business remains compliant.

- Wide Range of Verification Options: IDfy offers a comprehensive suite of verification tools, catering to diverse needs.

- Excellent Customer Support: They provide dedicated customer support to assist you with any queries or technical issues.

How Does IDfy Ensure Security and Compliance?

IDfy prioritizes security and compliance to create a trustworthy ecosystem. Let’s explore how they achieve this:

Data Protection Measures:

IDfy takes data security very seriously and implements robust measures to protect user information:

- Bank-Grade Encryption: Data is encrypted at rest and in transit using industry-standard AES 256 encryption, ensuring only authorized personnel can access it.

- Access Controls: Strict access controls are in place to limit access to user data. Two-factor authentication (2FA) is mandatory for all users, adding an extra layer of security.

- Regular Audits: IDfy’s infrastructure undergoes regular security audits to identify and address any potential vulnerabilities.

Compliance with Regulations and Standards:

IDfy understands the importance of regulatory compliance. They adhere to a wide range of industry standards and regulations, including:

- KYC (Know Your Customer): IDfy’s solutions help businesses comply with KYC regulations which help prevent money laundering and terrorist financing.

- AML (Anti-Money Laundering): Their platform incorporates AML checks to further mitigate financial risks.

- GDPR (General Data Protection Regulation): For European users, IDfy ensures compliance with GDPR regarding data privacy and user rights.

- PCI DSS (Payment Card Industry Data Security Standard): For businesses handling financial transactions, IDfy adheres to PCI DSS to safeguard sensitive payment card data.

Case Studies Showcasing Security and Compliance

Here are some examples of how IDfy’s commitment to security and compliance benefits businesses:

- A leading bank: IDfy’s KYC solutions helped the bank streamline customer onboarding while ensuring compliance with regulations, preventing fraud, and protecting customer data.

- A global e-commerce platform: By implementing IDfy’s verification tools, the platform successfully reduced fraudulent transactions and enhanced user trust, leading to a significant increase in customer satisfaction.

Streamline Onboarding with IDfy

Verifying user identities is crucial for any business operating online. However, integrating a new solution can seem daunting. IDfy offers robust solutions for businesses. Let’s explore how to effectively implement IDfy in your organization:

Integration Process and Requirements

Here’s a breakdown of the IDfy integration process:

- Account Setup: Contact IDfy to create an account and obtain your API key and account ID.

- Technical Integration: Their team can assist with integrating IDfy’s APIs into your existing system. The process may involve customizing workflows and configuring data capture methods.

- Testing and Deployment: Once integrated, thoroughly test the verification process to ensure smooth functionality. Once satisfied, deploy IDfy for your users.

Training and Support for Users

IDfy offers resources to ensure a smooth user experience:

- User Documentation: Comprehensive documentation guides users through the verification process, explaining what to expect at each step.

- Training Videos: Clear and concise video tutorials provide a visual walkthrough of the verification journey.

- Customer Support: IDfy’s dedicated support team is available to address any user queries or technical issues that may arise.

Measuring Success and ROI

To gauge IDfy’s impact on your business, consider these metrics:

- Reduced Fraud Rates: Track the decrease in fraudulent activities after implementing IDfy.

- Faster Onboarding Times: Measure the time saved in user verification compared to previous methods.

- Improved Customer Satisfaction: Monitor customer feedback to see if the verification process is smooth and user-friendly.

- Increased Conversion Rates: Analyze if a streamlined onboarding process leads to more users completing registrations or transactions.

Future Trends and Innovations in Identity Verification

The landscape of identity verification is constantly evolving, with new technologies emerging to address evolving needs and security threats. Let’s explore some key trends and innovations shaping the future of identity verification:

AI and Machine Learning in Identity Verification

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing identity verification. Here’s how:

- Enhanced Real-Time Verifications: Beyond traditional static ID checks, AI-powered liveness verification combines physical document inspection with biometric analysis. This ensures legitimacy and prevents synthetic and computer-generated fraud.

- Single-Vendor Solutions: Streamlined identity verification processes are now achievable through single-vendor solutions. These integrate document and biometric checks, enhancing user experience and bolstering fraud prevention efforts.

- Automated Scan Quality: AI-driven solutions automate document capture, guiding users for error-free results. This is crucial in countering sophisticated AI-generated attacks.

- E-Documents and Mobile Verification Risks: As e-documents rise, zero-trust-to-mobile approaches verify data on servers to ensure authenticity and integrity.

- Digital Wallets for Identity Management: Digital wallets are expanding to include identity management, signaling a shift towards adaptive solutions.

Biometric Authentication: Frictionless and Secure

Biometric authentication utilizes unique physical characteristics like fingerprints, facial recognition, and iris scans to verify identity. This method offers:

- Increased Convenience: Biometric verification can be faster and more convenient than traditional methods like passwords.

- Enhanced Security: Biometrics are unique to each individual, making them a more secure way to verify identity compared to passwords or tokens.

IDfy at the Forefront of Innovation

IDfy is actively incorporating these cutting-edge technologies into its platform:

- AI-powered Workflows: IDfy leverages AI to automate verification processes, streamlining onboarding and reducing manual intervention.

- Advanced Biometric Solutions: They offer facial recognition and liveness detection features to ensure a secure and user-friendly verification experience.

- Continuous Innovation: IDfy constantly researches and integrates new technologies to stay ahead of the curve and address emerging security challenges.

Potential Developments and Advancements

The future of identity verification holds exciting possibilities:

- Multimodal Verification: Combining biometric authentication with other verification factors like document checks can create a more robust security layer.

- Decentralized Identity Management: Blockchain technology could revolutionize identity management by giving users greater control over their data.

- Continuous Authentication: Passive, ongoing authentication based on user behavior could further enhance security without interrupting user experience.