What Is the Relative Strength Index (RSI) indicator?

- RSI indicator is a momentum indicator, used for technical analysis to determine the stock price’s strength and amplitude.

- To give you a little background on this widely used indicator, J. Welles Wilder was the creator of this indicator .

- The RSI is representes as a line graph, that oscillates between a range of 0 to 100.

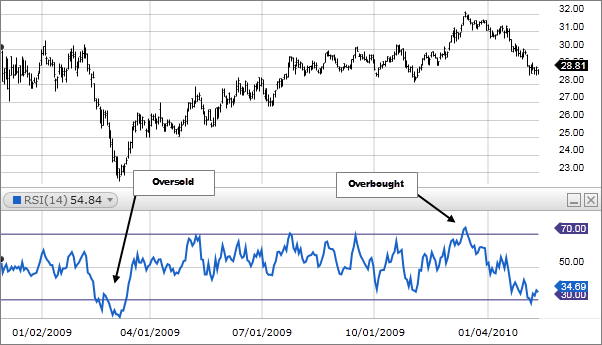

-Values of 70 or above on the RSI indicator indicates that investment is becoming overbought or overpriced. It may be ready for a trend reversal or corrective retreat in price. The RSI reading of 30 or below indicates that the market is either oversold or undervalued.

But keep a note The RSI may stay in overbought or oversold territory for lengthy periods during strong moves.

What does RSI indicator measure?

Traders use the Relative Strength Index (RSI) to assess a stock’s or other investment’s price momentum. The RSI’s primary concept is to track how rapidly traders are bidding up or down on a security’s price. The RSI depicts this result on a scale of 0 to 100. Stocks with a rating of less than 30 are deemed oversold. While Stocks with a rating of more than 70 are considered overbought. Traders will often display this RSI chart alongside the security’s price chart to compare the security’s recent momentum.

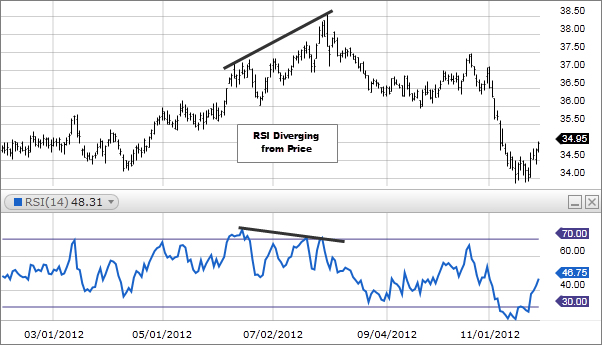

What is RSI Divergence?

A bullish divergence occurs when the RSI shows an oversold reading followed by a higher low that correlates to similarly lower lows in the market. This indicates that bullish momentum is gaining traction, and a break above the oversold region might mark the beginning of a fresh long position.

A bearish divergence occurs when the RSI shows an overbought reading followed by a lower high that matches the price’s higher highs.

A bullish divergence found when the RSI created higher lows while the price formed lower lows, as shown in the chart below. Although this was a genuine indication, divergences are uncommon when a company is in a long-term trend. More possible signs identified by using flexibly oversold or overbought readings.