In the rapidly evolving landscape of digital transactions, Razorpay has emerged as a game-changer, reshaping the online payments scene in India. In this case study, we delve into the journey of Razorpay, exploring its mission, challenges, solutions, impact, and prospects.

Razorpay is a leading fintech company in India, specializing in online payment solutions. Established in 2014 by Shashank Kumar and Harshil Mathur, Razorpay aimed to simplify online transactions for businesses of all sizes. Through its innovative technology and customer-centric approach, Razorpay quickly gained traction in the market.

Background and Overview of the Company

Razorpay is a fintech company based in Bangalore, India. It was founded in 2014 by IIT Roorkee alumni, Harshil Mathur and Shashank Kumar. The duo identified a significant problem in the market – enabling frictionless transactions was a major challenge and no one seemed to be doing it right.

They decided to tackle this problem head-on and thus, Razorpay was born. The company provides a fast, affordable, and secure way for merchants, schools, e-commerce, and other companies to accept and disburse payments online. They offer clean, developer-friendly APIs and hassle-free integration2, making it a preferred choice for businesses looking for end-to-end payment solutions.

Mission and Vision

Razorpay’s vision is to be a unified financial technology platform for millions of businesses. They aim to further digital adoption and equip businesses, especially in tier 2 and 3 cities, with industry-leading technologies that will help ensure business resilience.

Their mission is to enhance the payment experience of over 300 million end consumers. In doing so, they aim to enable Indian businesses – big and small – to accept payments digitally with minimal effort and maximum ease.

Razorpay is not just about providing a service, it’s about revolutionizing online payments by providing developer-friendly APIs and hassle-free integration. They are committed to making online transactions as seamless as possible, thereby contributing to the growth and success of businesses across India.

Challenges Faced by Razorpay

Highly Competitive Market

The fintech industry is a highly competitive space, with numerous players vying for market share. Razorpay operates in a market dominated by giants like Shopify Pay, Klarna, and Amazon Payments. These competitors offer similar services, making it crucial for Razorpay to constantly innovate and differentiate itself to stay ahead.

Razorpay has managed to carve out a niche for itself by focusing on providing a seamless, developer-friendly platform. However, maintaining this edge requires continuous innovation, understanding customer needs, and adapting to market trends.

Regulatory Hurdles in the Payment Industry

Regulatory challenges are a significant hurdle in the fintech industry. Razorpay, like many other payment aggregators, has faced regulatory restrictions from the Reserve Bank of India (RBI). These restrictions, which included a ban on onboarding new merchants, significantly impacted Razorpay’s growth and revenue.

However, Razorpay has managed to navigate these challenges effectively. After a year-long embargo, Razorpay secured the final approval from the RBI to operate as a payment aggregator. This not only paved the way for them to add new merchants and accelerate growth but also brought them within the regulatory fold of the central bank for the first time.

Building Trust and Credibility among Users

Trust and credibility are paramount in the realm of online transactions. Razorpay has made significant strides in building trust among its users. They have achieved this through stringent Know Your Customer (KYC) processes, ensuring that every Razorpay merchant is one they can vouch for.

Razorpay is also the first fintech company in India to achieve the SOC 3 compliance milestone, a beacon of trust and credibility in the fintech world. This certification signifies a commitment to safeguarding sensitive financial data.

Despite these achievements, building and maintaining trust is an ongoing process. Razorpay continues to focus on providing seamless financial solutions and fortifying its payments ecosystem with cutting-edge technology.

Solutions Implemented by Razorpay

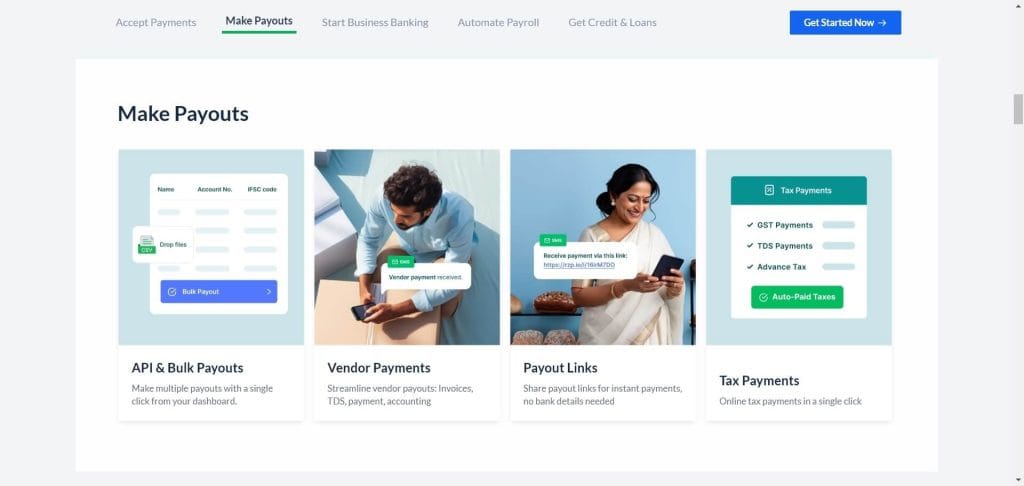

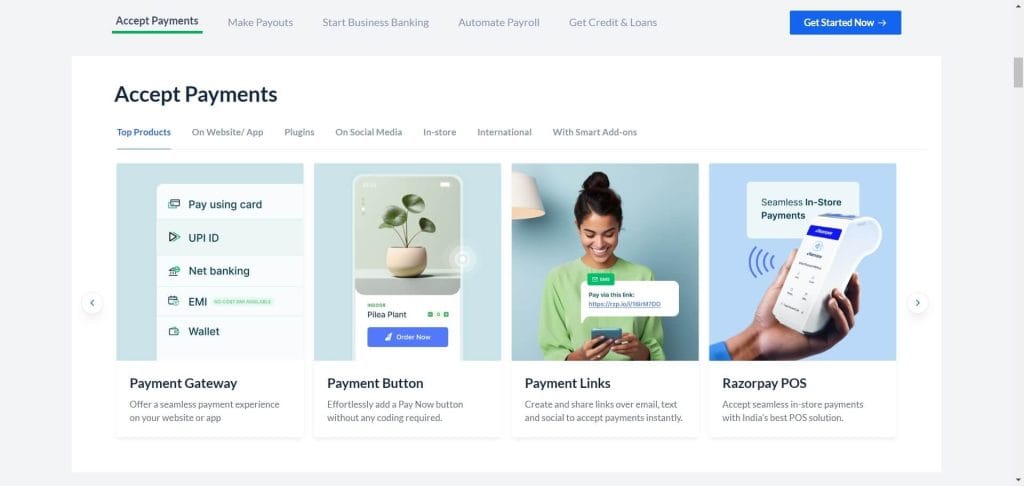

Razorpay has implemented a suite of solutions to address the challenges faced by businesses in managing online transactions. Here are some of the key solutions that have been implemented by Razorpay:

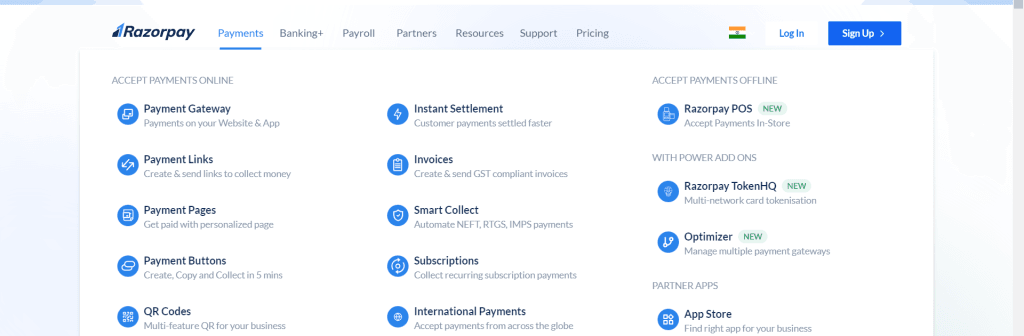

1. Razorpay Payment Suite

The Razorpay Payment Suite is a comprehensive solution that allows businesses to accept and disburse payments online. It supports over 100 payment methods, including credit/debit cards, net banking, UPI, and wallets. The suite also offers features like instant activation, easy integration, API-driven automation, and a superior checkout experience.

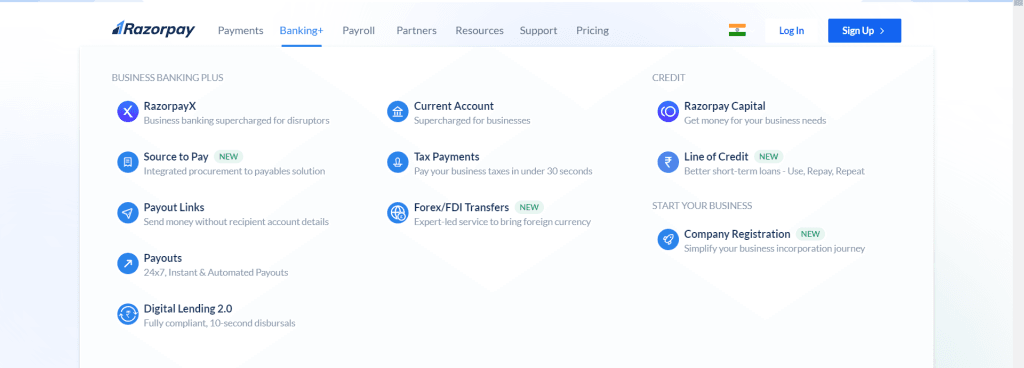

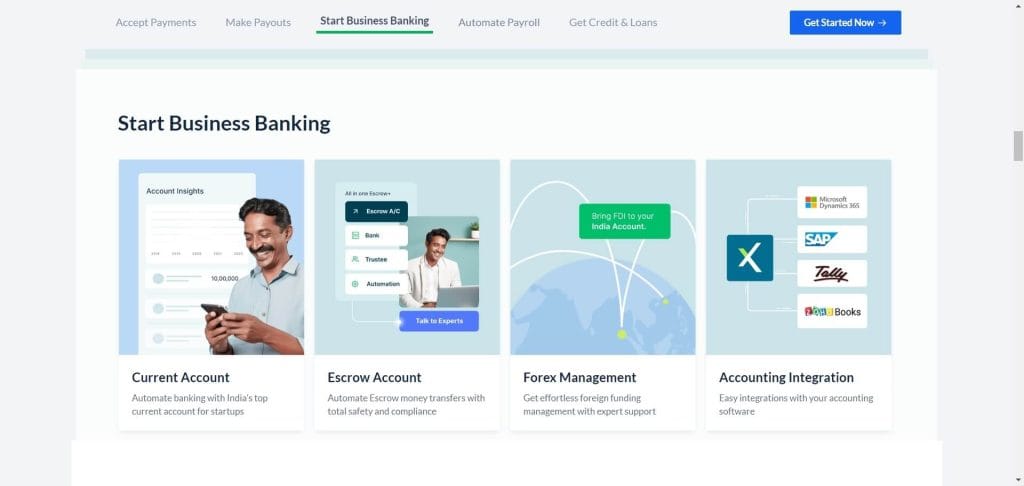

2. RazorpayX Business Banking

RazorpayX is a business banking platform that allows businesses to manage their finances and supercharge their banking operations. It offers features like opening a fully digital current account, automating payables and receivables, simplifying and tracking spending with corporate cards, and viewing financial insights at a glance.

3. Razorpay Thirdwatch

Razorpay Thirdwatch is an AI-driven tool that helps businesses reduce Return to Origin (RTO) losses by identifying and flagging fraudulent transactions. This helps businesses save on time, money, and effort.

4. Razorpay Payment Pages

Razorpay Payment Pages allow businesses to take their store online instantly with zero coding. It supports both domestic and international payments.

5. Razorpay Payment Links

Razorpay Payment Links provide businesses with the flexibility to share payment links via email, SMS, messenger, chatbot, etc., and get paid immediately.

6. Razorpay Subscriptions

Razorpay Subscriptions allow businesses to set up subscription plans with automated recurring transactions on various payment modes.

Also read | Top 6 online payment gateway in India

Results and Impact

Razorpay has experienced a significant increase in its user base over the years. The company aimed to grow its user base to 10 million by the end of 2021 from 5 million at the start of the year. As of 2022, Razorpay powers payments for over 8 million businesses. This growth is a testament to the effectiveness of Razorpay’s solutions and their ability to meet the needs of businesses.

Rapid Growth in User Base

Razorpay has experienced a significant increase in its user base over the years. The company aimed to grow its user base to 10 million by the end of 2021 from 5 million at the start of the year. As of 2022, Razorpay powers payments for over 8 million businesses. This growth is a testament to the effectiveness of Razorpay’s solutions and their ability to meet the needs of businesses.

Increased Transaction Volume and Revenue

Razorpay’s transaction volume has seen a remarkable increase. The company processed $60 billion in transactions annually, up from $5 billion in 20192. In 2021, Razorpay achieved $60 billion in total payment volume (TPV) through its platform, 20% more than the $50 billion it had targeted for the year. The company is now targeting $90 billion in TPV for 2022.

In terms of revenue, Razorpay had a total revenue of around two billion Indian rupees in the financial year 2022. The company expects over four years of growth in volume and revenue by 2022.

Recognition and Awards in the Industry

Razorpay’s innovative solutions and significant impact on the fintech industry have not gone unnoticed. The company has received several recognitions and awards. Razorpay was voted as The Economic Times Startup of the Year 2022. This recognition was a testament to the firm’s journey over the last eight years.

Furthermore, Razorpay became the first Indian company to be named in the 2022 Forbes Cloud 100 List, the definitive ranking of the top 100 private cloud companies in the world. This listing brought additional responsibility for Razorpay, acting as a new force of motivation.

Future Outlook and Expansion Plans

Razorpay, a leading fintech company in India, has been making waves in the financial technology sector with its innovative solutions. As we look ahead, the company has ambitious plans for diversification and expansion. Here’s a glimpse into the future of Razorpay.

Diversification of Services

Razorpay has always been at the forefront of innovation, continuously diversifying its services to cater to the evolving needs of businesses. The company started as a payment gateway provider, but over time, it has expanded its offerings to include a suite of financial services.

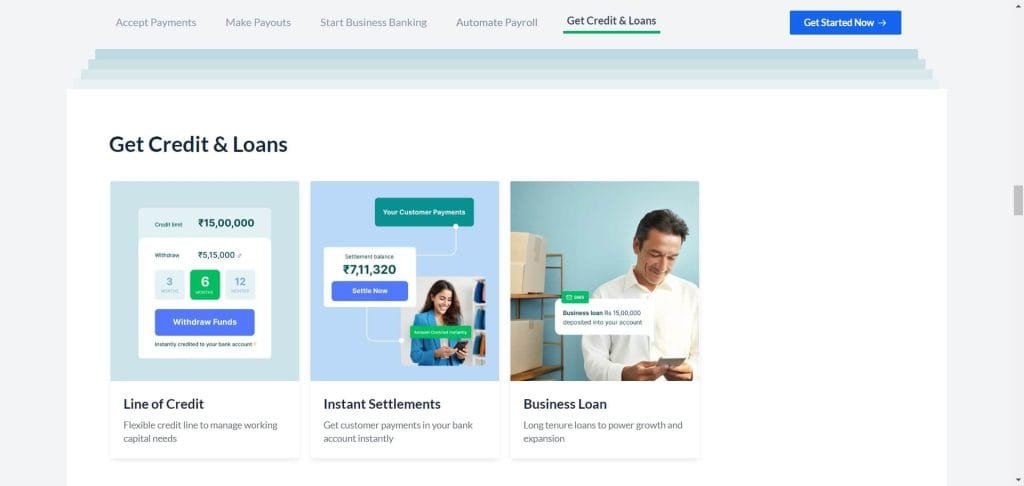

Razorpay now offers a comprehensive suite of services, including RazorpayX Business Banking, Razorpay Thirdwatch, Razorpay Payment Pages, Payment Links, and Subscriptions. These services are designed to manage tasks such as cash flow, money disbursement, bank wires, and the collection of regular payments.

The company’s diversification strategy is driven by the need to provide a one-stop solution for businesses. As businesses grow, their financial needs become more complex. Razorpay aims to address these needs by offering a range of services that simplify financial management.

Target Markets for Expansion

Razorpay has set its sights on international expansion. The company entered Malaysia last year and is now eyeing markets such as Indonesia, Vietnam, and the Philippines. This expansion into Southeast Asian countries is part of Razorpay’s strategy to tap into new markets and reach a larger customer base.

The company’s expansion plans are backed by a strong growth trajectory in the domestic market. Razorpay has seen a significant increase in its user base and transaction volume in India. The company aims to replicate this success in international markets by offering innovative and customer-centric solutions.

In addition to geographical expansion, Razorpay is also planning to expand its services. The company plans to invest in new acquisitions and build payment solutions for Southeast Asian countries. This will allow Razorpay to offer a broader range of services and cater to the unique needs of businesses in these markets.

Also read | Razorpay, Open, Cashfree, and others acquire Payment Aggregator licenses

Conclusion

Razorpay’s journey from a startup to a market leader in online payments exemplifies the transformative power of innovation and perseverance. By addressing challenges head-on and delivering value to its customers, Razorpay has revolutionized the way businesses transact online in India.